EntroPay was the first European virtual prepaid credit card and it was revolutionary in that it could be accepted anywhere Visa or Mastercard payments were accepted online or over the phone. Now EntroPay is widely accepted by millions of merchants globally. Entropay is the solution to the most security-conscious gamblers, as it generates a virtual credit card under the Visa umbrella that you can use wherever Visa is accepted. As for finding which sportsbooks accept it, don't worry.

What is Entropay

EntroPay is an online payment method often referred to as a Virtual Visa because it uses the Visa network for online payments. Even though EntroPay is a completely separate company, the fact that they use the association with renowned Visa brand makes it very popular and attracts a lot of customers. The company is based in the UK and Malts and has been around for more than 10 years by now.

EntroPay customers can make an online purchase and pay for services where the Visa card is normally accepted, which is as you guessed everywhere. The main difference is that EntroPay is not a credit card but a prepaid debit card, so the only money you can spend here is the money that you have decided to load on the EntroPay account earlier. That makes it especially popular among casino players since it helps them to better control their casino spending.

How to get EntroPay account

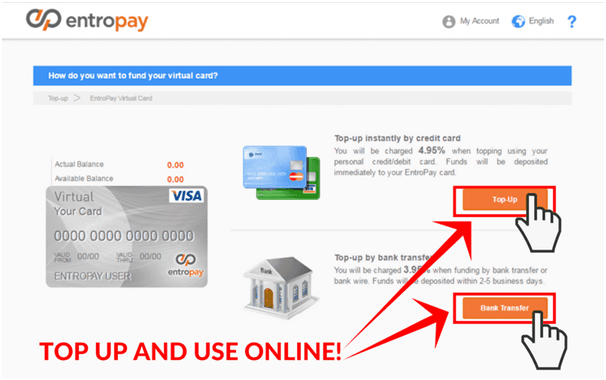

Opening an EntroPay account is easy and free. All you need to do is go the EntroPay website, fill in the registration form and your account will be open. The only time you need to pay is when you're loading your card with cash. To do that you can use your normal debit or credit card as well as bank transfer and a few other payment methods.

Once your registration process is over, you will receive the Virtual credit card number, expiry date and CVV 3-digit code. At many respected online casinos, you will be able to choose the EntroPay option from the deposit methods and make your deposit using the credit card details in the same way as it is for the usual credit/debit cards.

Advantages of using Entropay at the online casinos

- All your payments with EntroPay virtual card are processed immediately, so you can instantly see the money arriving at your casino account and start playing and winning.

- If you wish, you can obtain the actual physical EntroPay plastic card to use it in the stores or ATM or just use the virtual card, if you wish. The choice is yours.

- EntroPay Virtual Visa has a handy Digital Currency Converter, which can be used to convert between 14 different currencies.

- The Entropay system is trustworthy and secure, not only it has been around for a while but it also uses the 128 bits encryption technology, so you don't need to worry about the safety of your transactions.

- As we mentioned earlier, EntroPay system allows you to have a more strict control over the deposits you make at the casino. We all know that sometimes we just want to keep playing and depositing a little bit more. With EntroPay it's easy to make sure that you don't go over your budget and don't spend money that is meant for other important things in life.

Which UK casinos accept Entropay

Entropay Sign In

Another advantage of EntroPay is that the majority of the professional and high-quality online casino operators in the UK will let you use this payment method. In addition to that you will also have the opportunity to receive a wonderful casino welcome bonus up to £1,500 and up to 440 free spins when you first deposit at the new casino with your EntroPay virtual card. Below you see the comprehensive list of the best and most generous UK casinos that will accept EntroPay. The sticky bandits. Choose the one that you like, deposit, play and good luck!

Sports Betting Guide

EntroPay is a virtual Visa card of the prepaid type, which allows you to realise transactions everywhere where Visa cards are accepted. More often now EntroPay is the payment system offered by bookmakers.

What is EntroPay?

EntroPay is a virtual Visa card, the functionality of which does not differ from other credit cards. You can refill your virtual card within several minutes transferring money from your traditional credit or debit card (here only a small fee is taken, more information in the EntroPay's Minuses section). Using EntroPay we are sure that our bank account and credit cards are fully safe since they are used just in the process of refilling EntroPay's account for a set sum. All other transactions are realized just by the virtual card EntroPay.

Principles of using EntroPay

The payment system EntroPay is very simple in use. You should just register on the site www.entropay.com and fill EntroPay's account by funds using a tradition credit or debit card or a bank account and…in general, that is it. Our virtual card EntroPay is ready for usage and we can safely transfer money to anybody in the world (of course, using this payment system).

EntroPay's pros:

- Quick and simple way of transferring funds – a simple registration and quick transfer make EntroPay one of the most convenient payment systems.

- There is no need to check credit history – anyone can use this system.

- Huge anonymity – instead of personal data, e-mail and so on, you just indicate EntroPay user number.

- EntroPay cards are a widely available payment system – due to cooperation with Visa many enterprises and firms accept it.

- Globality – you can manage your funds from any place in the world using several available language versions and the most suitable currency for you (GBP, EUR, USD).

- High reliability – all data regarding your bank account and so on are secured from hackers. Moreover, you transfer the amount of money you currently need to your virtual EntroPay card.

EntroPay's usage cons:

Nothing in the world is free. Safety of your money also costs. In this case we do not speak about big sums, but in its turn, you have to bear some costs which are connected with EntroPay's usage. Although registration of an account and virtual cards are free, depositing of it by a traditional credit card has a commission free od 4,95%. Withdrawal of funds from a bookmaker account to v's card costs 1,95% of commission fee, and the flow of monetary funds between two virtual EntroPay cards will correspondingly cost $0,20/£0,10/€0,15. In its turn, back transfer of money from a virtual card to your traditional credit card will cost $6/£3/€4,50.

Answers to frequently asked questions about EntroPay

How much does a virtual EntroPay card cost?

The card itself is free, commission is set at the moment of financial operations.

Casino websites uk. Can you withdraw monetary funds from a bookmaker account directly to EntroPay card?

Yes, with the condition that you have deposited within the last 6 months to a bookmaker account using EntroPay.

Do I get a card which I can use to pay in shops, etc, when registering?

No, EntroPay card does not have a physical form, it is just a virtual card with the help of which a payment is realized entering information about it on EntroPay's site.

Can I use EntroPay with any currency?

What Is Entropy Chemistry

What Is Entropy Pdf

At the moment only GBP, EUR, USD are accepted.

Contact : support@entropay.com